ABC COSTING AND PRICE MIX

Operating profit per unit for Brass faucets is 760. 1 the materials consumed 2 which pieces of equipment were deployed and 3 how many labor hours were spent to complete it.

Genevieve Wood I Picked This Diagram Because Of The Side By Side View Of The Contribution Margin And Traditional Income Statement I Felt Like You Can Easily S

To make right decisions management needs more accurate information about the optimal product mix and the restrictive bottlenecks of a company.

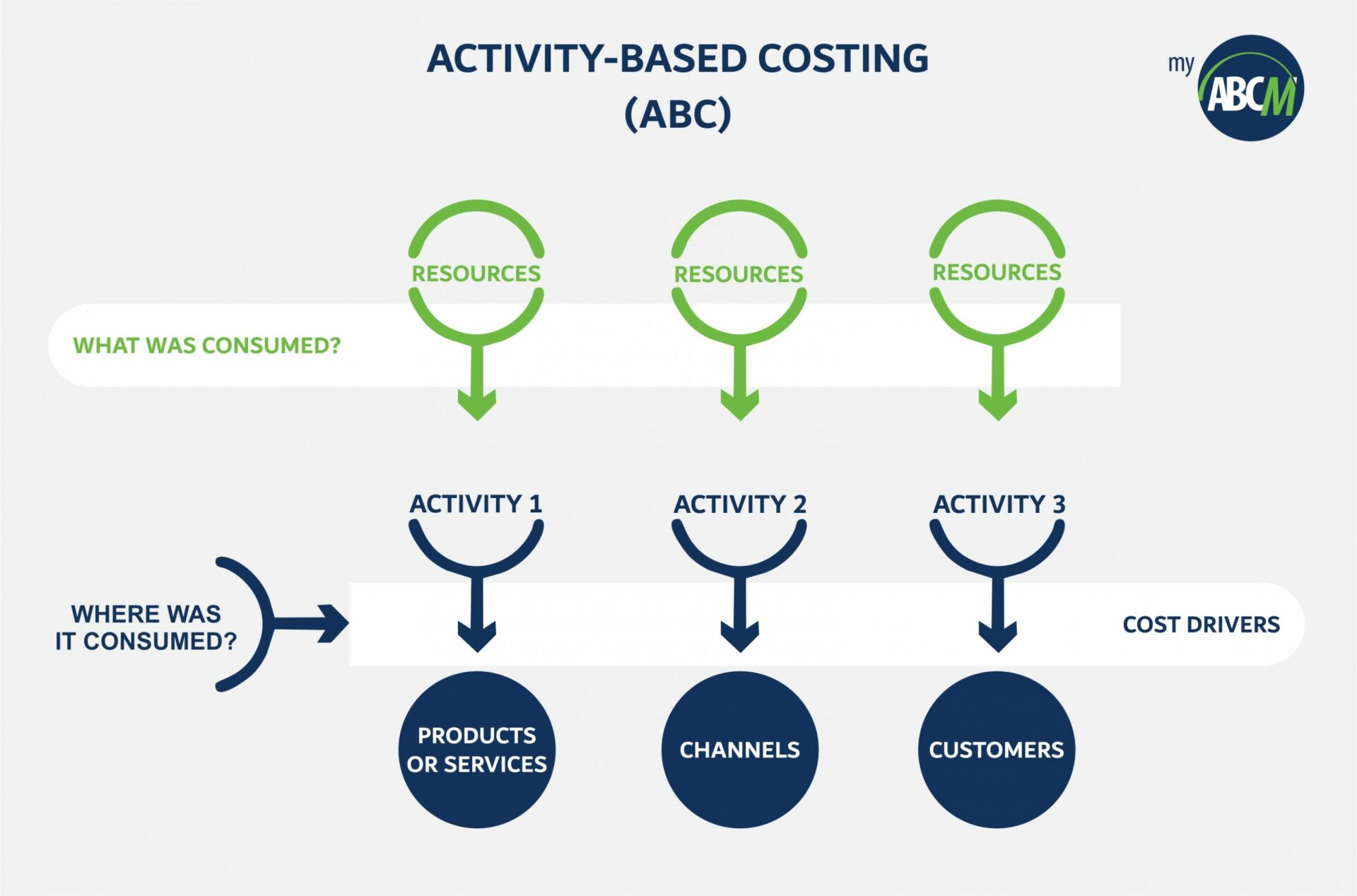

. Activities are transaction events tasks or unit of work for producing goods. Activity-based costing will quantify for each task. A lot of people are hurting because of high inflation.

Traditional Costing System vs Activity Based Costing. Select the activities and cost-allocation bases to use for allocating indirect costs to the products. Managers often need information presented in a different format in order to make operational and strategic decisions.

Ryan Sweet a senior economist at Moodys Analytics crunched the numbers and determined that current price levels are costing the typical family about 250 a month in extra spending. The concept of ABC came into prominence with the development of ABM by cooper and Kaplan in 1988. 250 a month thats a big burden he told the Wall Street Journal.

Activity Activity Allocation Base Total Estimated Amount of Allocation Base Receiving Number of jobs 8000 jobs Preparation Number of. This accounting method of costing recognizes the relationship between costs overhead activities and manufactured products assigning indirect costs to products less arbitrarily than traditional costing methods. Of activities to arrive at a profit.

Because the products do not all require the same proportionate shares of the support resources of setup hours and inspection hours the ABC system provides different results than the traditional system which allocates overhead costs on the basis of direct labor hours. Identify the direct costs of the products. Activity-based costing ABC is a costing method that assigns overhead and indirect costs to related products and services.

This process allows you to track the progress of jobs in real time so you can correct mistakes and inefficiencies before losing money to them. Determining the best product mix of a company correctly is an important requirement to increase the profitability of a company. Moreover the most notable contribution is considered to be activity-based costing.

Ford Motor Company Assembly Line Dearborn Michigan 1927 ABC contrasts with traditional costing cost accounting which sometimes assigns costs using somewhat arbitrary allocation percentages for overhead or the. The underlying construct in ABC method is to rest on the premiss that merchandise usage activities and activities use resources. ABC emerged as a logical alternative to traditional cost management systems that tended to produce insufficient results when it came to allocating cost.

One such method is the activity-based costing ABC method which calculates the cost of activities and helps in making decisions on product mix. Cost driver rate which is calculated by total cost divided by total no. Activity based costing.

Identify the products that are the chosen cost objects. Activity based costing attempts to measure the costs of products and services more accurately than traditional cost accounting Photo. One such method is the activity-based costing ABC method which calculates the cost of activities and helps in making decisions on product mix and price for improving the utilization of resources and minimizing the cost of production.

Activity-based costing ABC is a costing method that assigns overhead and indirect costs to related products and services. Activity-Based CostingManagement ABCM is an Information System developed in the 1980s to overcome some of the limitations of traditional cost accounting and to enhance its usefulness to strategic decision-making. AN ACTIVITY-BASED COSTING SYSTEM 5-3 ABCs 7 Steps Step 1.

The ABCs of Activity-Based Costing. It helps to allocation overheads in systematic and scientific way. Some of them for example ABC and BSC have also gained a degree of popularity in practice Jarvenpaa 2007100.

Activity based costing ABC is an accounting methodology that assigns costs to activities rather than products or services. Activity based costing also known as ABC costing refers to the allocation of cost charges and expenses to different heads or activities or divisions according to their actual use or on account of some basis for allocation ie. The cost of a merchandise the cost of the natural stuffs the amount of the cost of all the activities required to bring forth that merchandise.

Activity-based costing ABC together with the. This enables resources and overhead costs to be more accurately assigned to the products and the services that consume them. ABC concentrates on the need to make a more realistic allocation of overhead cost.

One such method is the activitybased costing ABC method which calculates the cost of activities and helps in making decisions on product mix and price for improving the utilization of resources and minimizing the cost of production. The activity based costing approach justifies the transfer prices a multinational corporation uses to transfer unique company services among its divisions located in different countries. Revenue and expenses as reported on your companys income statement have limited usefulness to people inside the organization.

This article is an attempt to explain how this approach reduces. ABC helps to better understanding about overhead cost. Activity-Based Costing Steps Steps 2.

Thats where activity-based costing comes into play. Activity-based cost ABC and activity-based management ABM systems. This accounting method of costing recognizes the relationship between costs overhead activities and manufactured products assigning indirect costs to products less arbitrarily than traditional costing methods.

ABC is also called transaction based costing. Select allocation BASE for each activity and estimates total levels for each activity The base will differ by department depending on which activity actual CAUSES the costs to be incurred cost driver. The use of activity-based costing ABC on profitability analysis is called upon to help break down and analyze the nature of environmental costs in products that generate those costs in order to.

Abc Accounting Model Visual Charts Ppt Template Of Activity Based Costing Presentation Business Budget Template Bookkeeping Templates Cost Accounting

Activity Based Costing Everything You Need To Know About The Abc Methodology Myabcm

0 Response to "ABC COSTING AND PRICE MIX"

Post a Comment